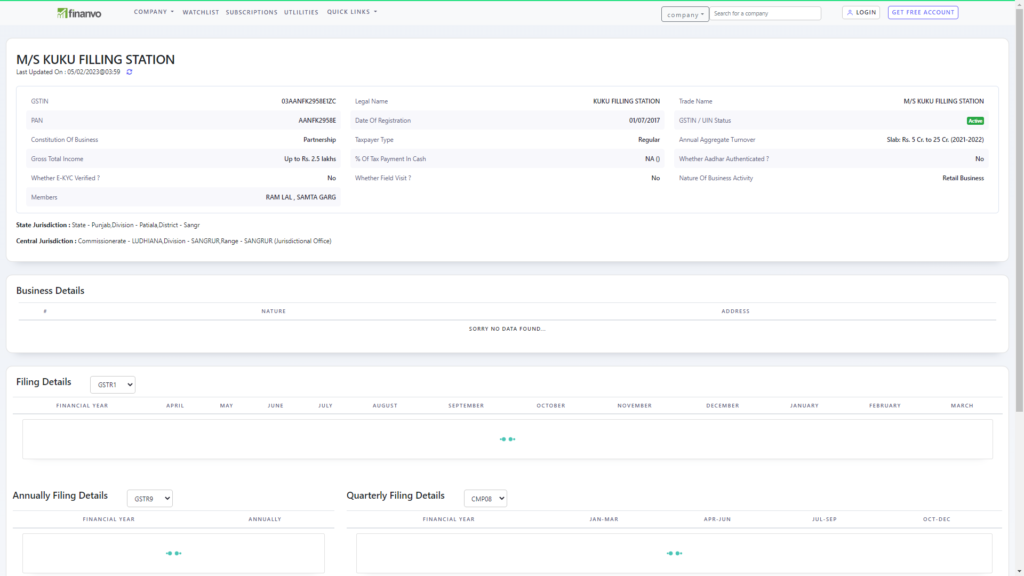

Integrate GST Verification API (Detailed) with Sales, Profit and Percentage of Cash slabs to fetch the GST taxpayer details. GST Verification API (Detailed) responds to GSTIN on a real-time basis. Integrate the APIs with your ERP and verify the GSTIN within seconds.

The GST Verification API (Detailed) by Finanvo is offered by the Goods and Services Tax Network (GSTN), which is the IT backbone of the GST system in India. For instance, it’s worth noting that this API can seamlessly integrate into various applications and software used by businesses. These applications and software include billing and accounting software, e-commerce platforms, and other financial management systems. Additionally, this API is highly versatile, meaning that it can be used in a wide range of scenarios, from simple invoicing to more complex financial operations.

The API validates the GSTIN by checking its format, structure, and validity against the GST database maintained by the GSTN. In addition, this API also verifies the status of the GSTIN, checking whether it’s active, canceled, or suspended. The API provides instant verification results and helps businesses to avoid errors, duplication, and fraud in their GST transactions.

DELIVERY OF INFORMATION

The GST Verification API is a useful tool for businesses to streamline their GST compliance and improve their overall efficiency. It helps them to ensure that they are dealing with genuine and authorized GST registered parties, which is crucial for maintaining the integrity of the GST system.

- PAN / State / Status

- GSTIN of the Tax Payer

- State Jurisdiction Code

- Legal Name of Business

- State Jurisdiction

- Taxpayer type

- Nature of Business Activity

- Legal Name of Business

- Address of Principal Place of Business

- Address of Additional Place of Business

- Date Of Cancellation

- Last Updated Date

- Date of Registration

- Constitution of Business

- Registration trade name

- GSTN status

- Centre Jurisdiction Code

- Centre Jurisdiction

- Nature of Principal Place of Business

- Nature of Additional Place of Business

- Date of Filing

- Return Type

- Tax Period Selected by User

- Status of the Return Filed

- ARN Number Generated After Filing

- Mode of Filing (OFFLINE/ONLINE)

- Is Return Valid/Invalid ?

- Additional Information (Detailed)

- – Annual Aggregate Turnover

- – Gross Total Income

- – % Of Tax Payment In Cash

Other Post on : PAN to GST Fetch APIs

For More Information :

Contact Details:

www.finanvo.in

support@finanvo.in

+919033024545