About Banking Sector

The banking sector faces fierce competition as customers become more selective. Banks seek to improve customer relationships and services to gain an edge. Finanvo provides up-to-date business data to help banks acquire more accounts and enhance customer satisfaction.

The banking sector is a highly competitive industry, and banks need to stay ahead of the competition to succeed.

To improve the coherence and flow of the text, it’s recommended to add more transition words in this sentence. Here’s an example:

By leveraging Finanvo’s services, banks can effectively gain an edge over their competitors. With access to accurate and up-to-date business data, banks can provide better banking services and enhance their customer relationships. As a result, they can attract more customers and increase their market share.

They can gain more bank accounts and increase their revenue streams, leading to long-term growth and success in the industry.

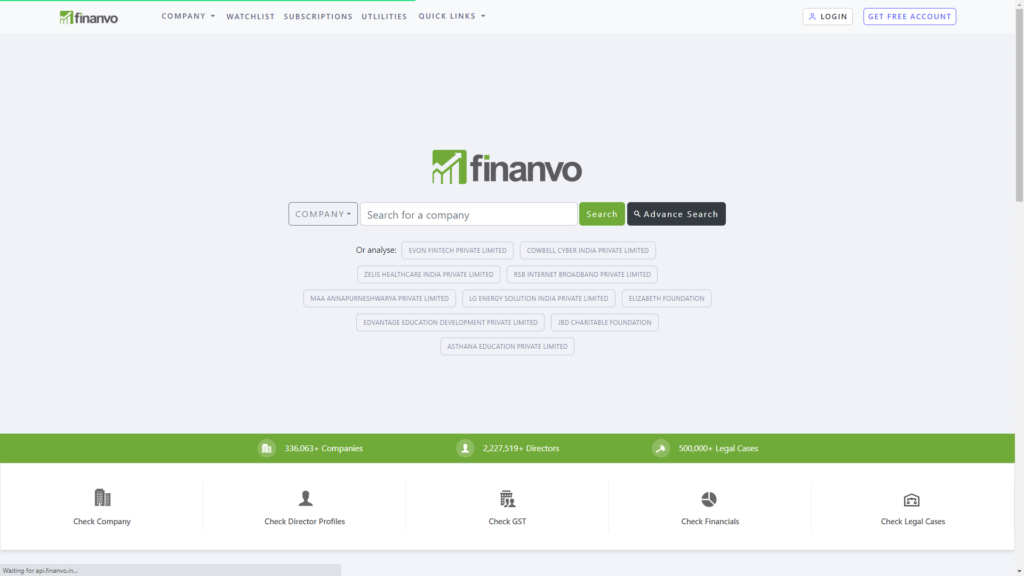

About Finanvo

To further enhance the coherence and flow of the text, it’s recommended to use transition words to connect the sentences. Here’s an example:

Finanvo is a leading data and information provider that offers accurate and up-to-date business data to businesses of all sizes. Their services aim to help banks improve customer relationships and increase revenue streams by providing access to precise contact information for new and existing customers. This can be invaluable for banks seeking to reach out to potential customers effectively and build stronger relationships with existing ones.

Furthermore, Finanvo’s vision focuses on developing sustainable solutions that increase productivity through advanced analytics and data-driven insights. By leveraging these insights, their users can make better decisions, optimize their operations, and improve their bottom line.

The banking sector has two main divisions: acquiring funds (CASA or liability) and lending the acquired funds (loans or assets).

For CASA – Liability

With the help of Finanvo’s services, banks can easily reach out to potential customers and offer them tailored banking services.

Finanvo’s key service is providing banks with accurate and up-to-date contact information for new and existing company directors, including CEOs and CFOs. This can help banks improve their customer relationships and expand their customer base.

This information can be invaluable for banks seeking to improve their customer relationships and expand their customer base. By having access to reliable contact information, banks can reach out to potential customers more effectively and build stronger relationships with existing ones.

By having access to accurate and up-to-date contact information, banks can communicate more effectively with their customers and build stronger business relationships. They can provide tailored banking services that meet the specific needs of their customers, leading to increased customer satisfaction and loyalty.

Banks get contact details for new companies and their directors the next morning. This allows bank personnel to create proposals based on factors like the company’s capital, address, director’s age, and relationship with other companies. Using multiple modes of communication, such as WhatsApp, direct calls, and emails, bank personnel can establish connectivity with relevant company representatives.

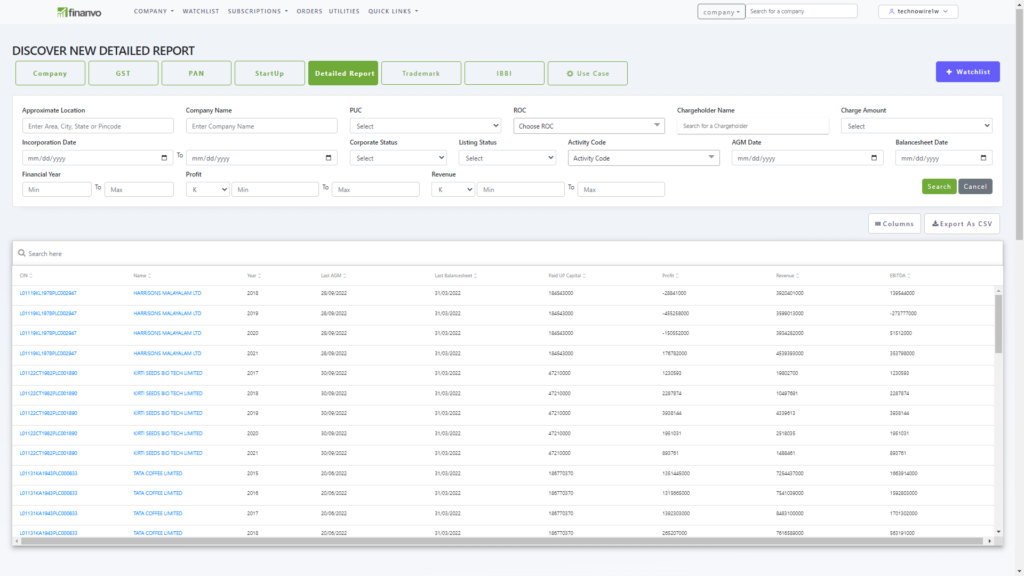

For Loans – Assets

The service enables bankers to filter companies based on competitor loans and charges and choose from a wide range of loans available in the market for takeover or fresh loans.

With the new service, bankers can easily identify potential clients that match their loan selection criteria. Filters in the service include company name and address, paid-up capital, borrowed loans and interest rates, security, margins available with existing banks, loan tenure, and period expired. By using these filters, bankers can quickly and efficiently identify the right clients for their loan portfolios.

After identifying the right client, the banker can draft a detailed proposal. The proposal is based on the offerings that the banker wants to provide. The banker can connect with the concerned person using the contact details provided by Finanvo’s Company Director Contact Services. This streamlined process ensures that the banker can quickly get the client onboard and offer them the right banking services.

“Our services provide accurate and up-to-date business data to enable effective communication with customers and tailored banking services,” said a Finanvo spokesperson, adding that they are proud to serve the banking sector and help improve customer relationships and gain more bank accounts.”

In conclusion, Finanvo’s services are a game-changer for the banking sector. Banks that use Finanvo’s services stay ahead of the competition and have achieved long-term growth and success in the industry.

Benefits of Using Finanvo’s Services:

By using Finanvo’s services, banks can benefit from:

- Accurate and up-to-date contact information for new and existing company directors.

- Access to multiple contact options, including mobile numbers and email addresses.

- Increased chances of reaching out to the right person at the right time.

- Better communication with key decision-makers, leading to stronger business relationships.

- Improved chances of success in providing banking services to businesses.

Conclusion:

Finanvo’s Banking Solution comprises new company director contact details and lending data which offer banks an efficient and effective way to reach out to new and existing companies. By having access to accurate and up-to-date contact information, banks can build strong business relationships with key decision-makers and increase their chances of success. We look forward to working with you to help grow your business.

Other Post on: Contact Details of Newly Registered Companies

For More Information :